2024 Spring Budget Adjustment

The above image is based on the previously approved tax increase of 6.6%. With the proposed change that Council will be discussing on April 23rd, the $8.74/day will increase to $8.76/day, a $0.02 increase for the average home in Edmonton which is $425,000.

City Council operates on a 4-year budget cycle. The 2023-2026 Operating and Capital Budgets were approved in December 2022. If you haven’t read my six-part budget blog from 2022, please start by reviewing those posts, you can do so using the following links:

Pre-Budget Blogs

Part 1: 10 Things You Need To Know

Part 2: Introduction to the 4-Year Cycle

Part 3: Budget Impacts on Ward Nakota Isga

Budget 2023-2026 Final Update

Part 1: Property Tax Changes Over the Years

Part 2: How I Voted on the Budget

Part 3: Common Themes from Edmontonians

At the time, the approved property tax increases were expected to be 4.96% each year except for 2026 which would be around 4.4%.

This was a big change from the 2019-2022 budget cycle where the property tax increases (and freeze in 2021) were the lowest increases in 25 years. At the time, the 2019 increase was the lowest increase in a decade (2.6%). In 2020, the increase (1.3%) was the lowest increase in 23 years. In 2021, the tax freeze (0%) was the first time that occurred in 24 years. Finally for 2022, we had the third lowest increase in 25 years (1.9%). These were all below the rate of inflation. And well below the rate of inflation and population growth.

At the end of every year, City Council will debate a supplemental budget adjustment. This doesn’t often result in significant changes but depending on the situation, there can be big changes. This happened in December 2020 where massive cuts were introduced to address the challenges due to the pandemic. That was also the case last year when during our budget adjustment meeting in December 2023 where we went up from 4.96% to 6.6%. If you want all the details on that discussion, you can read this post.

The majority of the additional 1.6% increase was to fund an increase in funding to Edmonton Police Service with a new funding formula in place, this now ensures that EPS has the necessary funding to address community safety. 0.3% of that increase went to increasing bus service and 0.1% went to increasing response to encampments. If you want more details on those, please use the link above.

So why is an additional 2.1% being requested on top of the previous 6.6%? There are a few important factors that our City Administration has identified.

An increase to the City of Edmonton’s WCB premiums: 0.3%.

A 1.8% increase to address a variety of new costs including the labour settlement with one of the civic unions and continued inflationary pressures that every household, business, and public organization is facing.

Rapid population growth that is at the highest level (percentage-wise) that we have seen in over 40 years and the highest ever yearly population growth in the city’s history (65,000 in 2023).

Massive reductions in provincial funding (both operating and capital).

I’m going to focus on points 2, 3, and 4 in this post as there isn’t much that can be done about new WCB premiums.

On point 2, for a number of years our frontline staff and City management have had their wages frozen. Although I know that is hard on our City staff, the pandemic created very uncertain economic conditions and so in order to keep the tax increases at the lowest point in the last 25 years, we made cuts and froze budgets in almost every area, except EPS, to help keep taxes below the rate of inflation from 2019-2022. We are at the point now where we are starting to shift our approach to start catching up after years of austerity.

The ratified CSU52 collective agreement includes a 0% salary increase for 2021, 1.25% for 2022, 2% for 2023, and 3% for 2024. This means that:

● A $28.2 million increase is required to the base budget starting in 2024 on an ongoing basis.

● The total retroactive pay for the salary settlement for the period 2021 to 2023 requires a one-time payment of $17.1 million.

● All current CSU 52 members will be receiving a one-time lump sum payment of $1,000. There are approximately 6,000 CSU members, so the lump sum cost is about $6 million in 2024.

If you have been following me over the last few months you likely have heard this number already: 100,000 people. That’s the number of people that moved into Edmonton in the last 2 years. This level of growth is unheard of and it’s creating massive financial pressure in a way we have never seen before. This growth is unlikely to slow down because Edmonton is by far and away the most affordable major city in Canada when it comes to housing.

Unfortunately, new residential development does not pay for itself. I wrote more about that in a post back in February: https://andrewknack.ca/blog/readyforit. When your city’s population is adding the equivalent of the City of Red Deer (third largest city in Alberta) every 2 years, that’s going to put massive pressure to add in all the necessary services that residents expect (ex: police stations, fire halls, libraries, rec centres, parks, etc.).

This leads into the final point about the massive reduction in provincial funding. In the previous link, there was a chart that shows how provincial infrastructure funding to municipalities has dropped by 64% since 2011.

This drop is significant and the continued underfunding of municipalities across Alberta is creating a massive financial burden. There is an infrastructure deficit across municipalities in Alberta of approximately $30 billion and it’s only getting worse. While Edmonton’s utility infrastructure is in much better condition, there are municipalities that can’t even fund the renewal of basic utility infrastructure.

Unfortunately, this isn’t the only reduction in funding we have seen over the last few years. Mayor Sohi recently released a letter that outlines some of the funding cuts and inequities that exist:

Reinstate the Grant in Place of Tax Program program retroactively to 2019, providing $60 million dollars immediately to eliminate Edmonton’s current deficit and reduce the pressure on the tax levy by approximately $14 million annually.

Revisit the Local Government Fiscal Framework funding formula to realistically address the growing infrastructure deficit occurring within municipalities and, at minimum, reinstate funding amounts to what was received per capita in 2011.

Reconsider allocations to ensure that grants reflect service responsibilities of large municipalities.

Fully fund Alberta Health Services emergency shigella outbreak response within the City of Edmonton, reducing the pressure on the tax levy by at least $2.2 million annually.

Review the police funding model and provide funding commensurate with the financial requirements necessary to operate a sustainable and well-equipped urban police force.

Reinstate funding for the DNA testing program, reducing the property tax burden on Edmontonians by $5 million annually.

Fully fund Emergency Medical Services within Edmonton, reducing pressure on the tax levy by $28 million annually.

Reinstate the municipal portion of fine revenue to 73.3%, reducing pressure on the tax levy by $7-8 million dollars annually.

Ensure equitable treatment between Edmonton and Calgary for maintenance of provincial highways within city boundaries, reducing the pressure on the tax levy by approximately $17 million annually.

You can read the full letter here. Most of these reductions have come in the last six years.

So What Do We Do?

Municipal property taxes will cost the average Edmonton homeowner $3240.89/year (approximately $270/month). While this amount only accounts for approximately 6.9% of all the taxes that the average household pays (see chart above), it’s the tax that most people feel because unlike your income taxes, which come off before going into your account, property taxes come out after you get your paycheque. That makes it more tangible even though it accounts for a much smaller percentage of what the average household pays.

Even though municipalities across Alberta are all facing similar cost pressures with property tax increases around what we are facing, I don’t believe it is likely that the provincial government will reinstate the infrastructure funding to 2011 levels. That leaves us with two main options to address rising costs and a growing population: cutting services or raising taxes.

Cutting Services

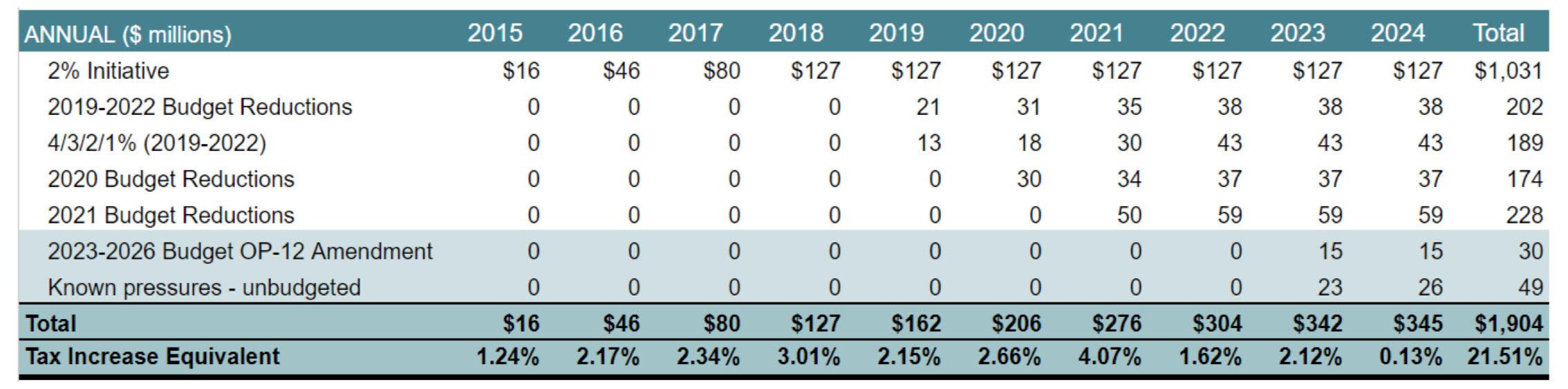

The chart above is the answer to the question: “Have you tried saving money?” The answer is always yes but I want to show some of the work that has been done over the three budget cycles that I have been a part of. Over the last 10 years, hundreds of millions of dollars have been cut from our budget.

This work started with the 2% Initiative introduced by Mayor Iveson which worked to find 2% savings each year from 2015-2018 that could be used to keep costs down or reallocated to other priorities. That wasn’t the only work, I previously introduced a motion during that same budget cycle to reduce the number of staff vacancies which helped to reduce spending by $13 million.

Leading into the 2020 Budget adjustment, I made a motion asking for what services could be cut to reduce the budget by 4/3/2/1%. As you can see from the chart, that did help produce further savings (approximately $45 million over 4 years) along with a separate initiative that started at the beginning of the 2019-2022 budget cycle.

There was a separate body of work that started in late 2020 in advance of the 2021 budget due to the pandemic. With very uncertain economic conditions, our City Administration found approximately $60 million in savings to help keep the tax increases to below the rate of inflation. Many of these cuts were more focused on things that people might consider more core services (ex: less frequent grass cutting). This work continued into the 2023-2026 budget through a process called OP12.

Another cut I want to highlight is our reduction to middle management. This is a group that can feel easy to pick on, “Just cut middle management” is an easy thing to type. With that said, the City of Edmonton did it. I brought forward a motion last term that resulted in a cut to middle management and now Edmonton has a substantially lower middle management ratio (approximately 13%) than the Government of Alberta (approximately 25%) and even the City of Calgary (approximately 18%).

This work will never stop because I believe that Edmontonians expect that we are always looking for efficiencies. But this is a chance to ask for your help. What are some of the areas you are willing to see reduced and to what level? Or do you even want to see a reduction in core services?

I’m going to reshare the image at the top so that you have a better sense of our biggest budget items.

If we are looking to reduce the budget in a meaningful way, we would need to look at the top budget items:

Edmonton Police Service

Debt Repayment for Infrastructure Projects (I’ll cover this in more detail below)

Transit

Neighbourhood Renewal

Fire Rescue Services

Roads and Traffic Management

Point 2: Debt Repayment for Infrastructure Projects needs a bit of context and I’ll use the example that people like to reference the most: bike lanes. If this project was cancelled, the tax increase for 2024 would decrease from 8.7% to 8.7%. No, that isn’t a typo, the overall reduction would result in a 0.02% tax decrease which is a rounding error on the total budget.

Cancelling capital projects doesn’t have the same impact as ongoing reducing services in our Operating Budget. The biggest capital projects in the City budget would be the Yellowhead Freeway Conversion, Valley Line West LRT, Lewis Farms Rec Centre, Terwillegar Expressway, 50th Street Overpass, and affordable housing. While I believe that some people will look at some of those projects and not feel they have value to them, I think it’s safe to say the majority of Edmontonians believe these are projects that are important for the future of our city.

Therefore, to have the largest impact on property taxes, reductions would be needed in Edmonton Police Service, Transit, Neighbourhood Renewal, Fire Rescue Services, and Roads and Traffic Management. From what I heard when knocking on doors, I don’t get the sense that these are areas people want to see reductions.

Safety is critical and I hear from far more people who want to ensure EPS and Fire Rescue Services are well-funded. I continue to see concerns on community Facebook pages about break-ins and while we’ve made a major investment in transit safety, that’s something we need to stay on top of to ensure the upward trend in safety continues.

On transit, while some people would be comfortable with less transit service, there are many areas where we need to at least sustain service levels or increase it (ex: the communities of Big Lake). Transit ridership is at the highest level in Edmonton’s history so a cut impacts the growing ridership.

Neighbourhood Renewal continues to be one of the most popular programs in the city’s history. If that money is cut, we will see an infrastructure deficit for infrastructure that had been neglected for decades. Finally, Roads and Traffic Management would include filling potholes, clearing snow, etc. I still don’t think we do enough on snow removal and since our roadway network has grown by about 20% in the last 5 years, any cuts mean that not only would we see less service on existing roads, we would not be anywhere close to keeping up with our growth.

Now it may be that people are comfortable with reducing those areas but that’s not been my experience over the years. That’s why I’m interested in your thoughts on this. What are some of those areas that you would consider changing and why? The why is important because if the answer is simply, “I don’t benefit from that service,” then that might not hold as much weight as someone that has some very detailed rationale.

I know this is a long post but I believe it’s important to provide this detail so that we can have a more complete conversation about a very important topic. I also know that any increase is hard, especially at this time. I never want to vote for a tax increase and after the lowest tax increases in 25 years from 2019-2022 combined with the most rapid growth in our city’s history, we are reaching an inflection point.

I’m going to spend the months leading up to the 2025 Budget adjustment engaging people about the budget. I’d love to see a budget roadshow across the city so that this information can be shared with all Edmontonians and then everyone can share their values and what they want to prioritize. While I have a good sense of that from my monthly door-knocking and community meetings that I host, this is a complex challenge that requires a dedicated effort to hear from as many people as possible.

Thank you for taking the time to read this and I am truly looking forward to your feedback. No one ever wants a tax increase, but especially now when almost every aspect of our lives are seeing similar increases. Considering our housing prices are lower than all the other major Canadian cities over 1 million people, our population growth is not expected to slow down anytime soon. We need to work together on this to ensure that we are coming up with the best solutions.

April 24th, 2024 Blog Update: After a lengthy debate, City Council unanimously approved an 8.9% tax increase for 2024. Years ago, I was given some words of wisdom by former Councillor Jim Taylor. He said that if a Council vote was unanimous or close to unanimous, chances are that if you had 13 random people and gave them the same information, they would likely come to the same decision.

I share that because as noted above, not one person is going to be happy with a large increase like that. Speaking for myself, I know that voting for any tax increase is not seen as a good way to earn support among those you represent.

Being that every member of council from across the political spectrum supported this budget that says to me that while no one wants this at all, the financial realities that we are facing in the City of Edmonton, and across many municipalities, are significant and we cannot hide from them.

With our population growing faster than ever before combined with the funding reductions referenced above, we are facing financial pressures like never before.

A decision to raise taxes is never easy. A decision to raise taxes when people are struggling is even harder. Although I believe this is the right thing to do for the long-term sustainability of our city, that won’t make it any easier on those who are seeing costs rise in every other part of their lives.

We have a lot of work to do. The work to find more efficiencies doesn’t stop. In fact, it has to ramp up. I think it’s same to assume the financial reductions aren’t going to be restored anytime soon which means we have to look at a number of areas that we are currently providing services in, especially those that overall with provincial jurisdiction (ex: housing), and decide if we can truly support those at a time where we are asking Edmontonians to pay for a large increase.