Budget 2023-2026 Final Update - Part 1: Property Tax Changes Over the Years

Budget 2023-2026 Final Update

This four-year Operating Budget cycle was approved for the following average property tax increase:

2023: 4.96%

2024: 4.96%

2025: 4.95%

2026: 4.39%

I did not vote in favour of the Operating Budget. For the Capital and Utility Budgets, I voted in favour of both of those budgets. Instead of writing one of the longest posts I’ve written, this will be a three part final blog that will cover the changes over the years to our budget, why I voted the way I did, and provide more context on some of the most common topics people contacted me on. While I know a lot of information is covered in each of these parts, I hope you take the time to review everything, including some pre-budget posts, and then share your feedback with me.

Here are the links to my pre-budget blog posts:

Introduction to the 4-Year Cycle

Budget Impacts on Ward Nakota Isga

Part 1: Property Tax Changes Over the Years

This post from a few years ago describes some of the changes over the years but I want to highlight a few key points. For the 2019-2022 budget cycle, the property tax increases (and freeze in 2021) were the lowest increases in 25 years. At the time, the 2019 increase was the lowest increase in a decade (2.6%). In 2020, the increase was the lowest increase in 23 years (1.3%). In 2021, the tax freeze was the first time that occurred in 24 years (0%). Finally for this year, we had the third lowest increase in 25 years (1.9%). These were all below the rate of inflation.

This is important to highlight because the perception of Edmontonians was that the tax increases were much higher. A survey was conducted earlier this year and Edmontonians thought that the average residential tax increase over each of the last three years was 4.8%. That’s not 4.8% total over three years, the assumption was that they increased 4.8% in 2020, 2021, and 2022.

The actual average over the last three years was 1.07%.

I also want to share two important charts with you.

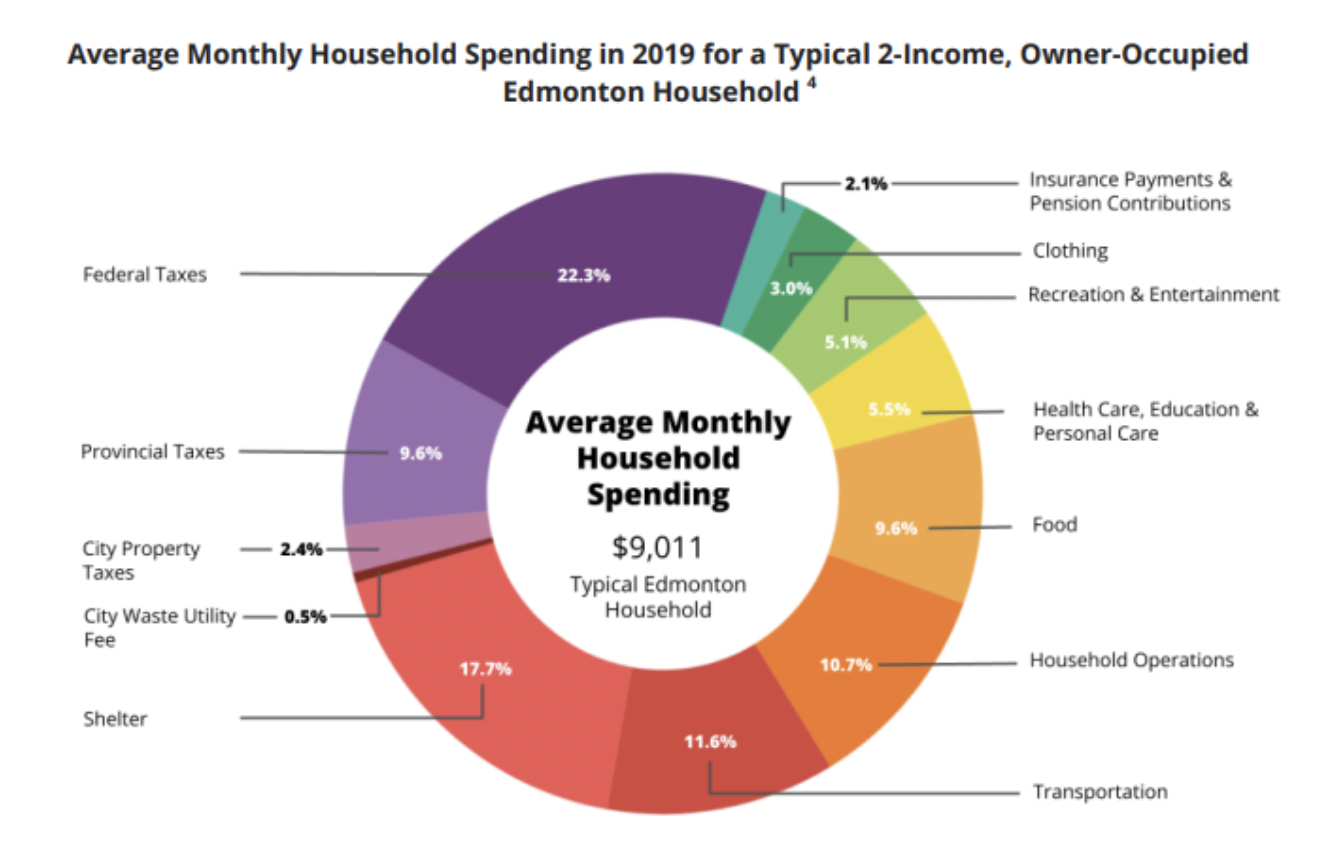

As you can see in the first chart from Statistics Canada, the amount of money paid by the average 2-income household on property taxes and waste utilities is the second lowest expense. On average, households spend more on clothing, recreation/entertainment, healthcare, education, and food. Provincial and Federal taxes are substantially higher than municipal taxes.

Therefore, it shouldn’t come as a surprise that municipal taxes and utility fees only account for 8.4% of the total taxes that the average Edmonton household pays with federal taxes making up 48.6% of the share and provincial taxes accounting for 43% of the share.

Even though municipal taxes account for such a small percentage of what we pay every year, it’s often the expense that generates the most attention.

One of the main reasons for that is because most of the provincial and federal taxes come off prior to having money deposited into your account. With property taxes, that amount comes out after we have received our pay so it’s more noticeable. When’s the last time you were with friends or family and discussed the amount of income tax that you paid? What about contacting your MLA or MP about the income tax brackets? But it’s very common for people to share their thoughts when property taxes increase.

I don’t provide this information to suggest that we shouldn’t closely watch how much is being spent by the municipal government. In fact, even with the level of attention people give to property taxes, I wish even more people were as focused on this. I’d also like to see the same level of attention or greater on provincial and federal taxes since they make up over 90% of the taxes we pay.

While there have been good and bad years in the past, the cost of living is going up at a rate more than any other year that I have been serving. That is important to acknowledge because each change to the city budget has a real impact on the lives of every Edmontonian. We have to take every decision made very seriously so that you can be confident that we have thoroughly reviewed every expense.

The next part in this blog series will detail how I voted on the budget and why I voted the way I did.