Operating Budget - Let’s Talk Savings

[embed]https://youtu.be/4LKf8GvLzRE[/embed] The financial future of the City of Edmonton is made up of two parts - the capital budget and the operating budget.

First of all, let’s breakdown the difference between the operating and capital budget. This section is taken directly from the City of Edmonton website, as they have done an excellent job explaining the difference between the capital and operating budget.“

The Operating Budget pays for the everyday workings of and interactions with the City. Whenever you talk to a City employee on the phone, pull over for firefighters rushing to an emergency, see a Council meeting on the news, renew your pet licence or read a City publication—this is the Operating Budget in action. The City of Edmonton’s Operating Budget projects the revenues and guides the spending for our civic services and programs. These are essential to the operations of our city and include police, fire rescue, snow clearing, pothole repair, libraries, park maintenance and recreation centres, as well as many others. The Operations Budget ensures that we have lifeguards, accountants, librarians, detectives, engineers, city planners, bylaw officers, receptionists and a host of other employees to make the City work for you. The City of Edmonton does not budget for a deficit or plan for surpluses. The taxes we collect are required to provide the essential amenities and level of service that Edmontonians expect from our prosperous, growing city.

The Capital Budget pays for everything we build, refurbish and renew. When we build new recreation centres, replace bus engines to extend their life, lay down new LRT tracks or repave the road in your neighbourhood, that’s the Capital Budget. Past Capital Budgets have addressed key growth and renewal priorities. And as we progress into a new Capital Budget, we are doing so on the heels of unprecedented investment in key infrastructure and improvements like public transit, neighbourhood revitalization, libraries, fire and police protection, new parks and recreation buildings, and bridge construction — all benefiting Edmontonians and meeting the needs of our transforming city. In order to maintain Edmonton’s momentum, we must carefully focus on what we need to invest in most while we build the infrastructure we’ve already approved and committed to, such as the Valley Line LRT. As new capital projects continue to be built, the budget must also grow.”

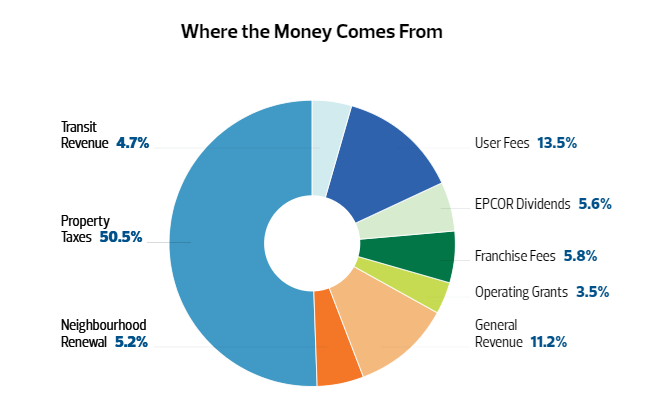

Examples of items that will be voted on in the 2019-2022 operating budget include public transportation, neighbourhoods and parks, road maintenance, emergency services, etc. Examples of items in the capital budget would be back alley renewal, the Lewis Farms Recreation Centre/Library, widening roads, industrial area upgrading, etc. The City of Edmonton gets money to fund these projects and services from a variety of sources, as indicated in the following chart.

The budgets that are currently being discussed are proposals from Administration at the City of Edmonton. These budgets will then be reviewed and debated by City Council to ensure that all areas and people in Edmonton are being served. In the new few weeks, I will also be releasing the consolidated results and themes from the survey I put out on the capital budget in October.

Administration is proposing is property tax increases of 3.3% for 2019, 2.7% for 2020, and a 2% increase for both of 2021 and 2022. These increases are a result of pressures to maintain, grow, and change services, previously approved increases, and dedicated Edmonton Police Service funding. If approved, this is expected to result in a typical Edmonton homeowner with an assessed home value of $397,000 paying an additional $79 per year in 2019, $72 in 2020, $52 in 2021 and $56 in 2022. Of course, just because this is being proposed by Administration does not mean Council will approve every aspect of the proposed budget.

To breakdown that cost further, of the 3.3% tax increase proposed for 2019; 1.7% (approximately $27.5 million) goes towards increasing the budget for Edmonton Police Services, 0.6% is for the Valley Line LRT, 0.3% is for Alley Renewal, and 0.7% is for general increases to services. This will come together to create the proposed expenditures in the graph below.

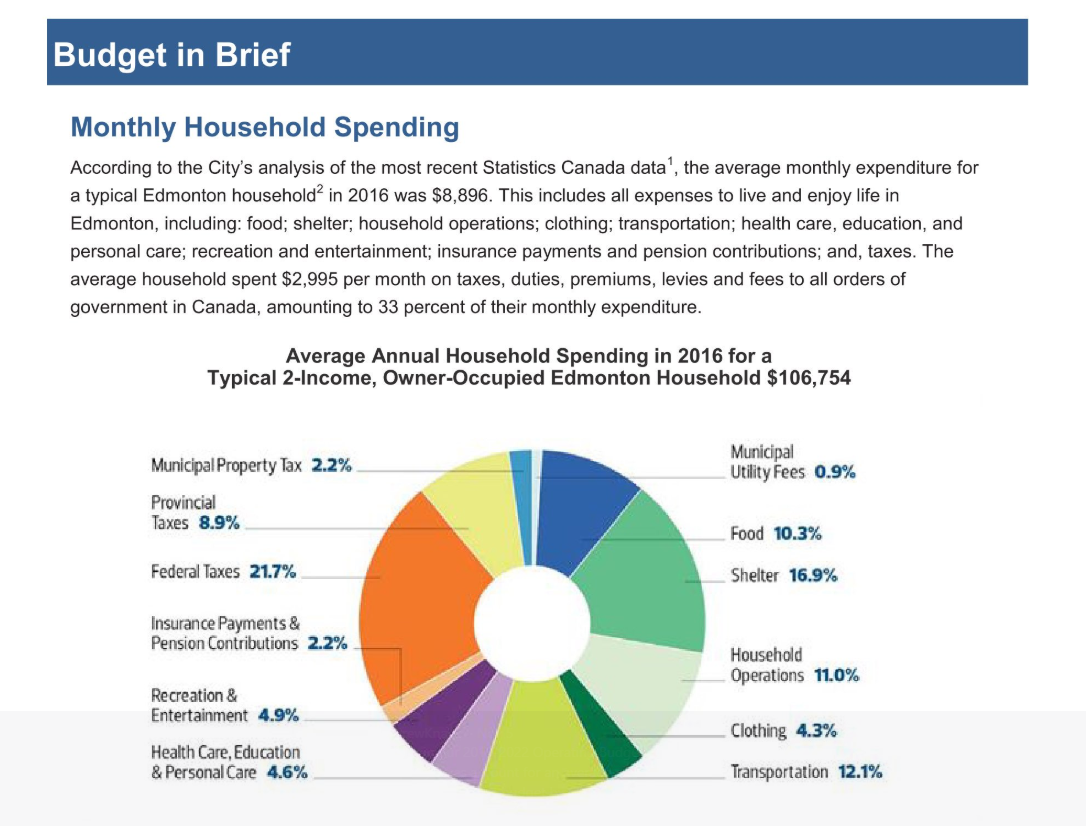

These proposals were calculated from a variety of citizen engagements, including traveling roadshows, surveys, and department budget submissions. When I ran for City Council in 2017, I campaigned on keeping tax increases in 2019 at or below inflation. As the inflation rate is trending high this year at 3.3%, simply reaching inflation is not good enough, we must strive for lower. We need to acknowledge that tax increases have an impact on everyone, particularly many of our seniors who are on fixed incomes. To paint a clear picture, the chart below breaks down the average household spending. Although property tax makes up a modest 2.2% - homeowners actually receive a physical bill, which makes the cost top of mind.

I frequently get asked what the City is doing to find fiscal efficiencies and keep costs down. Between 2013 - 2017, the City of Edmonton identified almost $68 Million in savings and efficiencies, which has set the stage for the 2019 - 2022 budget to build upon. Examples of these cost savings include Edmonton Transit’s new scheduling software which saved $27 million, services creating efficiencies in printed material and going paperless which saves paper and money, LED streetlight conversation which saved $300,000 and is better for the environment, and improving City of Edmonton volunteer programs which saved over $3 million.

Independent of that work, our Administration also started the Program and Service Review. The City of Edmonton has been administering program and service reviews, which includes completing a thorough review of each business area to ensure it is running as efficiently as possible. This review also includes support from external groups that form challenge panels. These panels, which are made up of business leaders, academics, and community members have already found and suggested efficiencies, and the work will continue over the next two years. The purpose of the Program and Service Review is to determine if municipal services align with the expectations of Edmontonians and Council by examining relevance, effectiveness and efficiency. Ongoing savings identified by the reviews completed in 2016 and 2017 total $2.4 million. Since 2018, there is a further $25 million that has been identified, this is broken down to $6.3 million in one time savings, $9.5 million of ongoing savings, and $9.2 million in cost avoidance. Examples of these savings include reducing mail delivery frequency, increasing production at City of Edmonton Tree Nursery, and improving functionality and convenience of online pet licensing.

Any efficiencies need to be done with care so that citizens are not negatively impacted by cost reductions. That is the purpose of completing the Program and Service Review. It’s also why I proposed a motion to provide a detailed list of services and expenses that could be changed, reduced, or cut. This list will show what a 1%, 2%, 3%, or 4% cut to the budget would result in so that we can clearly understand the impact of making specific cuts. There have been examples in the past where a motion was made at the end of the budget deliberations to reduce spending by a specific percentage. That approach is different than the motion I made because it shifts the responsibility of making challenging decisions from City Council to our Administration. I believe that if we are going to reduce spending, Council needs to approve those changes so that we can be held accountable for our decisions. As elected leaders, it is our responsibility to support the projects and services that will make a difference to the people in our city, while also respecting all Edmontonians by not spending beyond our means. It is all but certain that not everyone will be happy with the decisions City Council makes in this budget, as the reality is that we cannot afford to approve all items proposed and keep tax increases to below inflation. At the same time, ignoring our basic maintenance and substantial population growth over the last 20 years would not be responsible as that would create significant challenges for future Councils

.On November 28th, budget deliberations will begin. I have appreciated hearing from you about what you believe we need need and what can wait a little longer. If you have any additional comments or questions about the budget, I encourage you to reach out to share your thoughts.

Written by A. Knack and M. Banister.